The name Indyanna Daigle is becoming more familiar to many people who follow celebrity families. Even though she is the daughter of the well-known actress Erika Eleniak, she lives a quiet and private life. This mix of fame and privacy makes her story very interesting. Many fans want to know about her early years, her creative interests, and how she is growing into her own person. This article shares rare details about Erika Eleniak’s daughter Indyanna Daigle and explains why she is becoming a young star in her own way.

Quick Bio Table

| Category | Details |

| Full Name | Indyanna Daigle |

| Known As | Erika Eleniak’s daughter |

| Birth Year | 2006 |

| Nationality | American |

| Mother | Erika Eleniak |

| Father | Roch “Rocky” Daigle |

| Public Personality | Private, calm |

| Interests | Art, design, creativity |

| Public Appearances | Rare |

| Social Presence | Limited |

| Strengths | Independence, creativity |

| Future Path | Unknown |

| Family Bond | Very strong |

Early Childhood and Family Life

Indyanna Daigle was born in 2006, during a time when her mother, Erika Eleniak, was already a recognized name in Hollywood. Instead of raising her daughter under bright studio lights, Erika chose a calmer direction. She wanted her child to grow up with peace, safety, and normal routines, far from the rush of celebrity events. This allowed Indyanna Daigle to enjoy a childhood focused on family moments and personal growth.

Her father, Roch “Rocky” Daigle, also played an active role in shaping her life. Even though he is not a public figure, people know he helped create a stable environment. Together, the parents gave Indyanna Daigle a balanced home built on care and support. This strong family setting helped her develop confidence and a sense of identity from a young age.

A Childhood Close to Nature and Simpler Living

Instead of growing up surrounded by constant attention, Indyanna Daigle experienced a childhood full of simple joys. She spent time outdoors, enjoyed family trips, and explored her creative side through activities like drawing, crafting, and building her own ideas. These early experiences helped shape her calm personality and love for natural environments. They also allowed her to explore the world without pressure.

Her mother’s gentle approach played a big part in this. Erika Eleniak always spoke with pride about protecting her daughter’s space. She believed that giving Indyanna Daigle a simple childhood would help her grow into a stronger and more grounded adult. This thoughtful parenting helped the young girl build emotional strength and stay connected to her own dreams.

More Stories: LeTesha Marrow: The Woman Who Grew Up as Ice-T’s Daughter Before He Was a Star

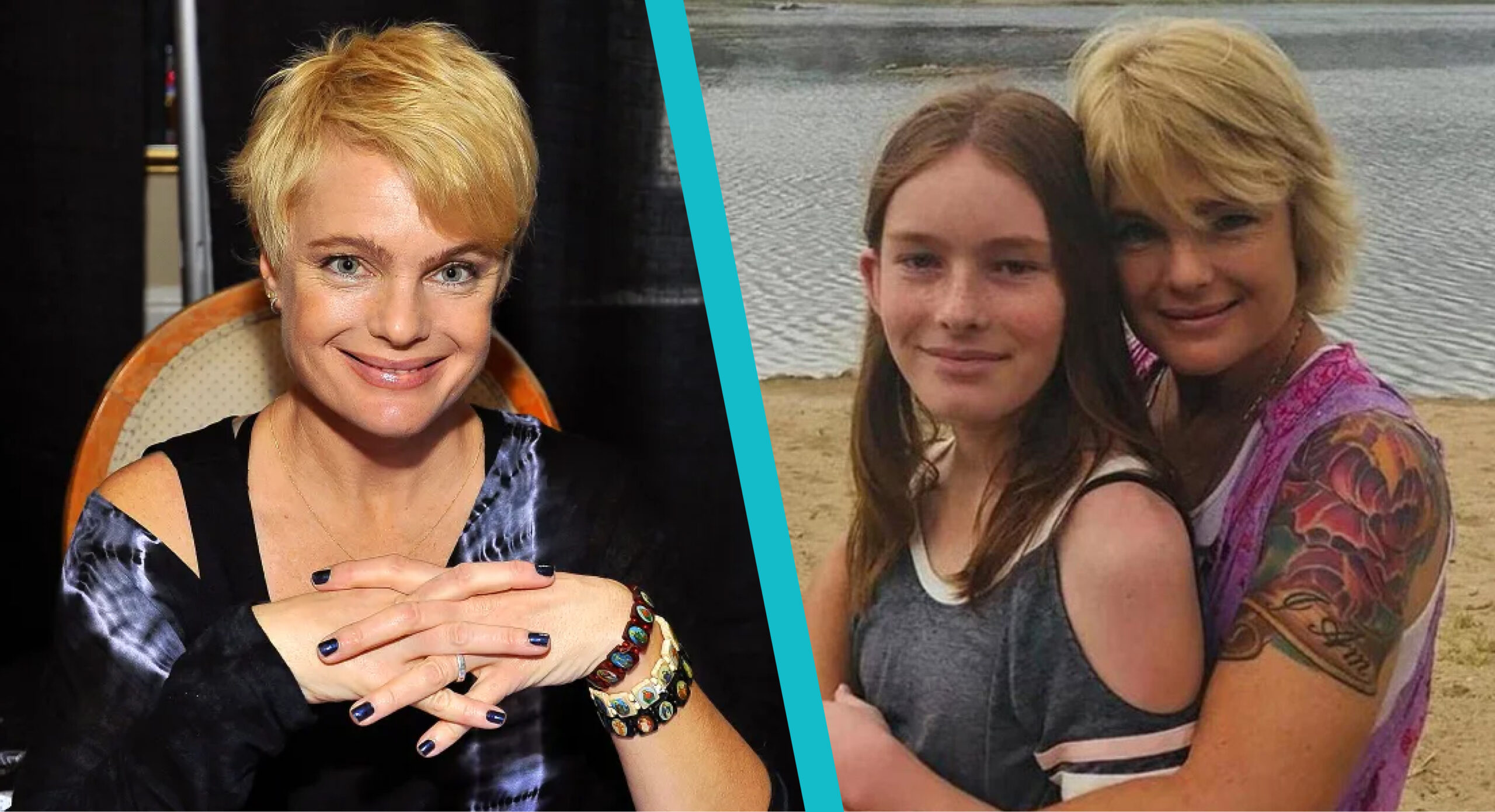

Strong Bond With Mother Erika Eleniak

The relationship between Indyanna Daigle and her mother is one of the most meaningful parts of her story. Erika Eleniak has often shared kind and emotional messages about her daughter on social media. She calls her a source of joy, strength, and new inspiration. These posts show a deep connection that continues to grow stronger as the years pass.

For many fans, these small public moments show the true heart of the family. They see a mother who loves her daughter deeply, and a daughter who inspires her mother every day. This warm bond has helped Indyanna Daigle feel supported while also becoming more independent. Their connection shows a positive example of how celebrity families can stay grounded through love and loyalty.

Private Life With a Public Name

Even though she is the daughter of a famous actress, Indyanna Daigle prefers to keep her life private. She does not appear often in public events and does not seek attention online. This choice shows maturity and self-control, especially for someone who could easily become a public figure.

Her privacy creates curiosity among fans. They respect her choice while wanting to know more about how she lives, learns, and grows. This careful balance makes Indyanna Daigle a unique figure—she is known, but not overly exposed. She chooses her moments with care, which adds to her quiet charm.

Creative Skills and Artistic Interests

Many people who follow her family have noticed that Indyanna Daigle is very artistic. She enjoys designing, sketching, and creating things by hand. Some small online pages connected to her name show creative fashion pieces and handmade designs. These artistic activities reflect her personality: calm, expressive, and full of imagination.

Her creativity makes people believe she may one day work in areas like design, art, or even independent fashion. She clearly enjoys expressing herself through color, texture, and personal style. Erika Eleniak’s daughter Indyanna Daigle seems to find comfort in creative work, and this passion may shape her future path.

Education and Personal Growth

While details about her school life are kept private for safety reasons, it is clear that Indyanna Daigle values learning. She seems to enjoy subjects that allow creativity and personal reflection. This includes art classes, design studies, and hands-on projects. These areas help her develop her natural talents even more.

Her focus on growth is also clear in her personal habits. She takes time to understand herself, learns new skills, and explores new ideas. This balanced life shows she is building a strong foundation for the future. Many people appreciate how Indyanna Daigle continues to grow with quiet confidence.

Life Free From Fame Pressure

One of the reasons people are interested in Indyanna Daigle is that she represents a different kind of celebrity child. She does not chase attention or rely on her mother’s fame. Instead, she builds a life based on personal interests and healthy choices. This makes her a positive role model for many young people.

By living away from constant cameras, she can enjoy her teenage years without the pressure of judgment. This freedom helps her focus on her dreams, friendships, and creative hobbies. Fans admire Indyanna Daigle for being herself and not following the usual Hollywood lifestyle.

Media Mentions and Public Appearances

Although Indyanna Daigle stays private, there are a few public photos and gentle mentions in the media. These usually come from family posts or simple lifestyle articles. None of them show dramatic headlines or unnecessary attention. This shows that the family values safety and respect above fame.

Her limited public presence also creates a sense of mystery. People see only small moments, which makes each new detail more meaningful. While many celebrity children live in the spotlight, Indyanna Daigle lives in a protected space that allows her to grow naturally.

The Future: What Path Might She Choose?

Fans often wonder what the future holds for Indyanna Daigle. Will she join Hollywood like her mother? Will she pursue fashion? Or will she choose a quiet career away from the public eye? At the moment, the answer is open. She has many strengths—creativity, emotional maturity, and independence.

Her future could include art school, creative business, or even community-focused work. She may also surprise everyone with a completely new direction. Whatever she chooses, it is clear that Indyanna Daigle is preparing herself with care, patience, and self-awareness.

Why Her Story Feels Inspiring

Many young people today feel pressure to follow trends or to show everything online. That is why the story of Indyanna Daigle feels refreshing. She chooses privacy, creativity, and simplicity. Her life shows that you can grow successfully without seeking constant attention. This message inspires teenagers and even adults who value personal peace.

Continue Reading: Goldie Ann Taylor Maintained a Low-Profile Even During Buck Taylor’s Fame

For fans of Erika Eleniak, her daughter’s journey is also heartwarming. It shows the positive side of celebrity parenting—love, protection, and respect. These values help shape a child who becomes strong, thoughtful, and kind.

Frequently Asked Questions

1. Who is Indyanna Daigle?

She is the daughter of actress Erika Eleniak and is known for her private and creative personality.

2. What is Indyanna Daigle known for?

She is known for her artistic interests and for staying out of the Hollywood spotlight.

3. Does Indyanna Daigle appear in the media often?

No, she rarely appears publicly and keeps her life private.

4. What does Erika Eleniak say about her daughter?

She often shares loving messages and says her daughter inspires her.

5. Will Indyanna Daigle join Hollywood?

Her future career is unknown, but fans remain interested.